How many people have told you that you'll never see a penny of the hard-earned money you've poured into the Social Security system and that you'd better have your own retirement savings tucked away somewhere? Perhaps those negative people are overstating the case, but even if you eventually do collect Social Security, it is likely to provide only a portion of the income you will need during retirement.

Congress responded to this problem several decades ago by creating a variety of tax-favored plans to help working people save for retirement. One such plan is set up by you, the individual taxpayer, and is appropriately called an individual retirement account or IRA. Another, which can be established by your employer or by you if you are self-employed, is referred to by the nondescript phrase, a qualified plan. A qualified plan is one that qualifies to receive certain tax benefits as described in Section 401 of the U.S. Tax Code.

There are other types of retirement plans, too, which enjoy some of the same tax benefits as qualified plans but are not technically qualified, because they are defined in a different section of the Tax Code. Many of these other plans closely follow the qualified plan rules, however. The most common of these almost-qualified plans are tax-deferred annuities (TDAs) and qualified annuity plans. (Don't be thrown by the name. Even though it may be called a qualified annuity plan, it is not defined in Section 401 and therefore is not a qualified plan in the purest sense.) Both of these plans are defined in Section 403 of the Tax Code. Because many of the rules in Section 403 are similar to those in Section 401, TDAs and qualified annuity plans are often mentioned in the same breath with qualified plans.

All qualified plans, TDAs and qualified annuity plans have been sweetened with breaks for taxpayers to encourage them to save for retirement. And working people have saved, often stretching as far as they can to put money into their retirement plans. The government's job is to make sure the plans are used as they were intended -- to help participants fund their own retirement .

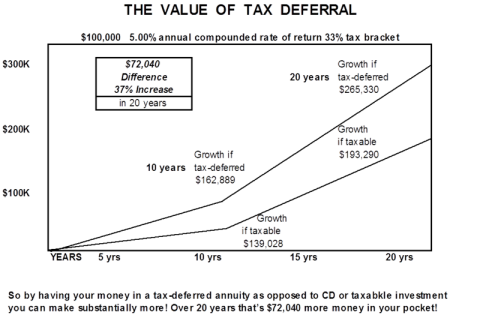

Annuities are an excellent alternative to CD’s as they are Tax-Deferred. The extra income you make over a period of time can be substantial Take a look at the chart below over 20 plus year you would make $72,040 on your hard earned money

Helping people with fixed money strategies - Did you know we can help with your IRA/401K rollovers and CDs.The plans we work with do not lose principal...

secure your retirement today! 877-967-4766

Call for a free TAX FREE RETIREMENT review today!

Request a Quote

Steven G Kiel

P.O. Box 910

Wildwood FL 34785

Phone: 877-967-4766

E-mail: steve@yourmoneyprotectors.com

Or use our contact form.

Client Services

Discover the advantages of insuring with Steven G Kiel Sr Learn more.