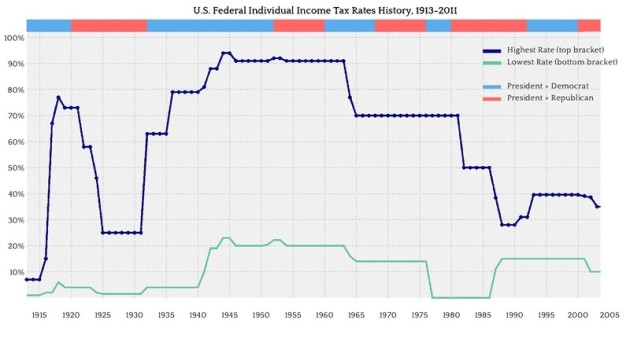

What direction do think future tax rates are going to go?? Your outlook on future tax rates may drive some of your retirement ideas for the future.

- If you think future tax rates will be lower, then saving today on a pre-tax basis, such as a qualified plan or Traditional IRA, makes a lot of sense.

- If you think future tax rates will be higher, then you may want to consider a tax-free retirement strategy such as a Roth IRA or permanent life insurance

Let’s take a closer look at tax-free retirement strategies.

Roth IRAs: Good choice……if you qualify. In order to contribute to a Roth IRA your adjusted gross income must be below a certain threshold. In 2011, contributions are limited to $5,000 per person unless you’re 50 or older and then you can contribute an extra $1,000 as a catch up provision.

What are your options if you don’t qualify for a Roth IRA, or if you want to contribute more?

Permanent Life Insurance: The primary purposes for purchasing permanent life insurance is for the death benefit protection that it provides. However, permanent life insurance offers the ability to build up tax-deferred cash value that can be accessed during your lifetime to generate a stream of retirement income – potentially income tax-free if done properly.

Call for a free TAX FREE RETIREMENT review today!

Request a Quote

Steven G Kiel

P.O. Box 910

Wildwood FL 34785

Phone: 877-967-4766

E-mail: steve@yourmoneyprotectors.com

Or use our contact form.

Client Services

Discover the advantages of insuring with Steven G Kiel Sr Learn more.